Digital real estate can be any type of property that exists in a digital state. It may be anything from websites and virtual products to online ventures and even virtual worlds.

If you’re considering investing in digital real estate, then you’re part of a growing crowd. This investment has seen an increase in popularity in recent times as individuals have begun to recognize the profits it can yield. One of the wonderful things about digital property is that it’s possible to invest in many ways. You can purchase online businesses and websites, rent virtual office space, or even own a percentage of a virtual universe. These properties can be resold and purchased just like other real estate and can grow in value over the years, providing a sure source of steady income.

What is Virtual (or Digital) Real Estate?

When we speak of digital real estate or virtual real estate, what we’re actually referring to are digital assets such as domain names, social media handles, and cryptocurrencies. Individuals might also refer to “virtual property” or “virtual land” when discussing properties within virtual reality environments.

Although virtual property does not accompany land or structures, it can be purchased, sold, and rented just like other forms of property.

Types of Digital Real Estate

Domain Names: A domain name is really the address of a site on the internet. Domain names can be purchased and sold, just like anything else, and their worth may appreciate with time. For instance, the domain “Business.com” was purchased in 2007 for $345 million. You can purchase and sell domains on websites such as GoDaddy.

Websites: A website is a group of digital properties residing on a server. Like domain names, websites can increase in value and be sold or purchased. Sites like Flippa permit individuals to sell and purchase websites.

Social Media Accounts: These are virtual profiles by which you can engage with other individuals. Just like any other virtual property, social media accounts can appreciate based on the number of fans or followers that they have. For example, The Rock’s Instagram account with more than 300 million followers was recently worth more than $300 million.

Virtual Office Space: This is virtual workspace where companies can conduct business online. You may lease or purchase virtual office space from firms that deal in this.

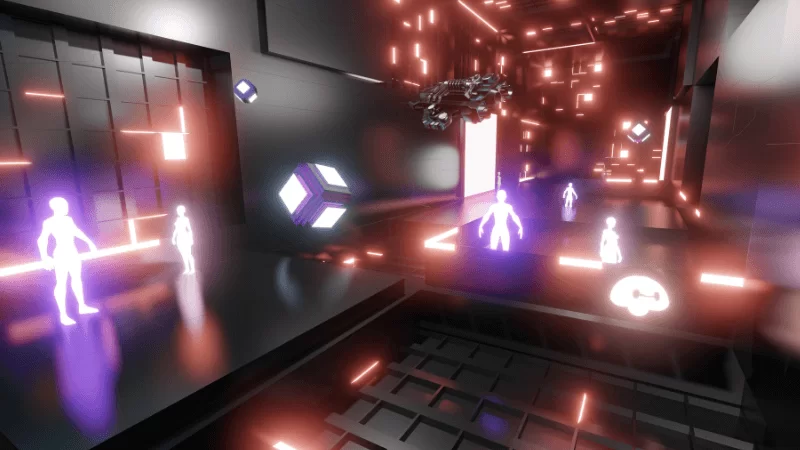

Virtual Worlds: These are virtual places where individuals can play games, interact with others, or even do business. Some examples of virtual worlds are games such as Second Life and Minecraft where you can purchase land, construct property, and even sell goods.

Benefits of Digital Real Estate Investment

There are numerous reasons why it is a good idea to invest in digital real estate:

High Return Potential: Most forms of digital real estate increase in value over time, so you can earn a profit selling them in the future.

Affordable: Virtual real estate tends to be significantly less expensive than physical real estate. For instance, you can purchase a website for a few thousand dollars, but a physical business could cost millions.

Easy Management: It is easy to manage virtual real estate because you can lease or rent it remotely. You do not have to be in the same city or even country as your property.

Diversification: Diversifying by investing in multiple types of digital real estate will reduce risk and maximize your potential return.

Scalability: Digital real estate is scalable. That is, you can extend the content or products on a website for more revenue.

Risks of Investing in Digital Real Estate

Still, like all investments, there are risks:

Investing in digital real estate is not without risk. Some of the risks include:

Value Fluctuations: The value of digital real estate can go up or down, meaning there’s potential to lose money if you’re not careful.

Cybersecurity Threats: Since digital assets are often stored online, they can be vulnerable to hackers and cybercriminals.

Limited Market: Sometimes it can be hard to sell digital real estate since there’s a more limited market compared to traditional real estate.

Legal Concerns: The legal framework for digital real estate is continuously developing, so you won’t enjoy the same legal safeguards you would with physical real estate investments.

Investing in Digital Real Estate

If you’re eager to get into digital real estate, here’s what you’ll need to do:

Do Your Research: Begin by doing some research on the various forms of digital real estate and determine what one is best for your interests and investment objectives.

Find a Trusted Platform: After you know what kind of digital real estate you wish to invest in, locate a trustworthy platform that enables you to purchase and sell digital assets.

Diversify Your Portfolio: To minimize risk, consider investing in various forms of digital real estate.

Monitor and Cash Out: Track your investments and cash out when the moment is right.

What is the Metaverse?

The Metaverse is a word that was first used by science fiction author Neal Stephenson in his 1992 novel Snow Crash. It describes a completely immersive virtual world that exists independently of the physical world. The Metaverse resembles virtual worlds, but it’s more sophisticated, providing more realistic and interactive experience. Users interact with both other individuals and virtual objects just as if they were in the real world.

While the Metaverse is still in the making, there are already platforms such as Second Life where users can build their avatars, purchase land, and establish businesses. Companies also endeavor to develop virtual reality headsets that give the Metaverse experience an even higher level of realism.

Alternative Methods of Investing in Virtual Real Estate

Below are some popular methods of investing in virtual real estate:

Start a Website or Blog: This is perhaps one of the simplest ways to engage in digital real estate. You can buy a domain name and hosting package for as low as $10 per month. Once you have your site up and running, you can begin making money through advertisements, affiliate marketing, or selling your own products.

Buy Websites Already in Use: If you don’t want to create a website from the ground up, you can purchase one that already exists. A lot of websites are for sale for a couple hundred dollars, and you can earn money once you own them.

Invest in Domain Names: You can purchase domain names you believe will become more valuable in the future. Then, you can just keep them and sell them when they appreciate.

Invest in Online Ventures: If you do not feel like running a website, you can purchase an online venture that already has a website, domain name, and hosting. Once you have purchased it, you can make money from ads, affiliate marketing, or selling products.

Invest in Virtual Worlds: Sites such as Second Life and Entropia Universe enable you to purchase land in virtual worlds. You may then sell, rent, or build on the land to generate a profit.

Invest in Cryptocurrency: Cryptocurrencies are another type of digital real estate. You can purchase and sell cryptocurrencies, or you can invest them in other virtual ventures.

Create and Sell Digital Products: You can create websites, apps, online courses, or products to sell on platforms like Udemy, Teachable, or Amazon. These can bring in passive income over time.

How to Make Money with Digital Real Estate

To make money with digital real estate, you can:

Flip Domains or Websites: Similar to flipping physical property, you can purchase websites or domains cheaply and resale them at a higher price. Sites like Flippa enable you to resell websites and domains to potential buyers.

Earn Passive Income: After you have acquired a digital asset such as a website or online business, you can have ads, affiliate links, or sell products to generate passive income.

Digital real estate is a fun and up-and-coming industry with lots of potential. Whether or not you have a desire to begin a website, invest in virtual worlds, or break into cryptocurrency, there’s some method for participation and money-making. Just be sure to do your research and know the risks before diving in!

More FAQs for Digital Real Estate

What is digital real estate?

Digital real estate refers to virtual properties that exist in the online world, such as websites, domain names, virtual land in online games, and even NFTs (Non-Fungible Tokens). The value of these assets is determined by their traffic, user engagement, rarity, or the potential for profit generation. As the digital world grows, so does the value of owning these virtual properties.

How can I make money from digital real estate?

There are several ways to make money from digital real estate:

- Buying and selling domain names: Purchase domain names that are likely to appreciate in value and resell them for a profit.

- Website flipping: Build, grow, and improve a website’s traffic and revenue, then sell it to someone else for a higher price.

- Investing in virtual land: Purchase land in virtual worlds like Decentraland or The Sandbox, and either hold it for appreciation or develop it to rent out or sell.

- Cryptocurrency investments: Buy and hold cryptocurrency or participate in blockchain-based real estate projects.

- NFTs: Buy, sell, and trade digital art or virtual property as NFTs, which can appreciate over time.

What are the risks of investing in digital real estate?

Like any form of investment, digital real estate carries its own set of risks:

- Volatility: Prices can fluctuate wildly, especially in the case of cryptocurrency or virtual land in digital worlds.

- Market uncertainty: The market for virtual properties and digital assets is still developing, so the value of these assets can be unpredictable.

- Technological obsolescence: New technologies or platforms may emerge, causing existing digital assets to lose value or become outdated.

- Scams and fraud: There have been instances of fraudulent schemes or stolen assets in the world of NFTs and cryptocurrency, so it’s important to be cautious and conduct thorough research.

How do I get started in digital real estate?

To begin investing in digital real estate, you should:

- Learn about the industry: Research different aspects of digital real estate, such as domain flipping, virtual land investing, and cryptocurrency. Understand the platforms you plan to use.

- Start small: Begin by purchasing low-cost digital assets or virtual land to learn the ropes before committing more capital.

- Utilize online marketplaces: For virtual land or NFTs, platforms like OpenSea, Decentraland, and The Sandbox are popular marketplaces to start buying and selling.

- Diversify your investments: As with traditional real estate, spreading your investments across different types of digital assets can reduce risk.

What are virtual worlds, and how do they relate to digital real estate?

Virtual worlds are online environments where users can interact, socialize, and participate in various activities. These worlds often have their own economy, including buying, selling, and developing virtual land or assets. Examples of virtual worlds include:

- Decentraland: A virtual reality platform where users can buy and build on virtual land.

- The Sandbox: A decentralized game world that allows users to create, own, and monetize assets and virtual property.

Investing in virtual land within these worlds can be profitable as these platforms grow in popularity.

Can you make a full-time income from digital real estate?

Making a full-time income from digital real estate is possible, but it depends on the time and effort you put into it, along with the knowledge and skills you develop. Many people make money on a part-time basis by flipping domain names or virtual land. However, professional investors and developers who specialize in digital real estate can turn it into a full-time business, especially by focusing on high-demand virtual assets or leveraging platforms like NFTs and cryptocurrency.

How can I ensure that my digital real estate investments are successful?

To maximize your chances of success in digital real estate:

- Do thorough research: Understand the value and potential of the digital property you’re investing in. Look for assets that have strong demand, historical appreciation, or utility.

- Stay updated: The digital landscape is constantly evolving, so keep an eye on market trends, new technologies, and emerging platforms.

- Diversify your investments: Just as with physical real estate, it’s important to have a diverse portfolio of digital assets to protect yourself from sudden market shifts.

- Protect your assets: Use strong security measures to protect your digital assets from theft or fraud, especially when dealing with cryptocurrency or NFTs.

Is digital real estate more profitable than traditional real estate?

Digital real estate offers a unique set of advantages over traditional real estate, such as lower initial investment costs and the potential for faster returns. However, the market is newer and more volatile, which means it can be riskier. Traditional real estate tends to offer more stability and steady growth over time. Both types of investments can be profitable, but digital real estate is still a developing market, so there’s more uncertainty involved.

What are NFTs, and how do they relate to digital real estate?

NFTs (Non-Fungible Tokens) are unique digital assets that can represent ownership of anything from art to virtual land. In the digital real estate space, NFTs can represent ownership of virtual property, buildings, or even specific digital assets within a game or virtual world. NFTs allow for transparent, verifiable ownership, and they are becoming an increasingly popular way to buy, sell, and trade digital real estate and other assets.

Conclusion

Digital real estate offers exciting opportunities for those looking to dive into the world of online investments. Whether you’re interested in virtual land, cryptocurrency, domain flipping, or NFTs, there’s a method of participation suited to various skill levels and interests. However, like all investments, it’s crucial to understand the risks involved, do your research, and stay informed about the rapidly changing landscape. By being strategic and patient, you could potentially see significant returns in this up-and-coming industry. Just remember that, as with any investment, success requires time, effort, and a careful approach to decision-making.