How to Calculate Time and a Half – A Simple Guide

Whether you’re working overtime, putting in hours on a holiday, or just want to double-check your paycheck, knowing how to calculate time and a half is a handy skill. It ensures you’re getting paid fairly for the extra time you put in—and who doesn’t want to make sure they’re getting every penny they earned?

In this guide, we’ll break it all down in plain English. You’ll learn what time and a half really means, when it applies, and exactly how to calculate it—step by step. We’ll also cover a few common scenarios, answer FAQs, and share some helpful tips.

Let’s dive in!

What Is Time and a Half?

Time and a half simply means that you’re paid 1.5 times your normal hourly wage for every hour worked beyond your regular schedule.

So, if your usual hourly rate is £10, then your time and a half rate would be:

£10 x 1.5 = £15 per hour

That extra 50% is basically your bonus for working overtime, weekends, or on a public holiday.

When Does Time and a Half Apply?

It depends on where you live and your company’s policy, but here are the most common situations where time and a half might kick in:

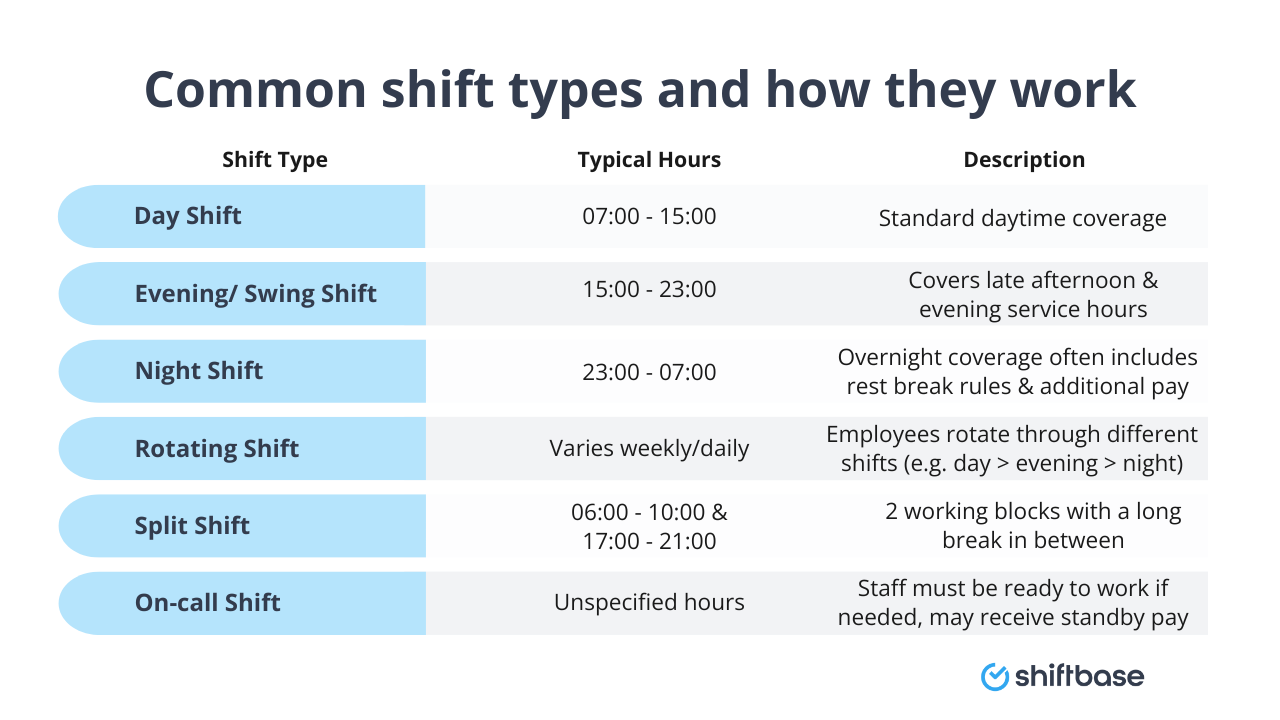

1. Overtime Hours

- In many countries, time and a half is paid for hours worked over 40 hours a week.

- Some employers pay it for more than 8 hours a day.

2. Holiday Work

- If you’re working on a public holiday, you may be entitled to time and a half—or even double time.

3. Weekend Shifts

- Some employers offer time and a half for weekend shifts, especially in retail, hospitality, or healthcare.

4. Emergency Shifts or On-Call Hours

- If you’re called in last minute or during unsociable hours, you might be paid extra as a thank-you for the inconvenience.

Note: Always check your employment contract, company policy, or local labor laws to see what applies to you.

How to Calculate Time and a Half (Step-by-Step)

Here’s a simple breakdown to figure out your time and a half pay.

Step 1: Know Your Regular Hourly Rate

This is the amount you normally earn per hour. If you’re salaried, you’ll first need to calculate your hourly rate.

To find your hourly rate from a salary:

- Take your annual salary

- Divide it by 52 (weeks in a year)

- Divide that by your weekly hours

Example:

Annual Salary = £30,000

£30,000 ÷ 52 = £576.92 per week

£576.92 ÷ 40 hours = £14.42/hour

Step 2: Multiply by 1.5

To get your time and a half rate, multiply your regular hourly wage by 1.5.

Example:

£14.42 × 1.5 = £21.63/hour (time and a half pay)

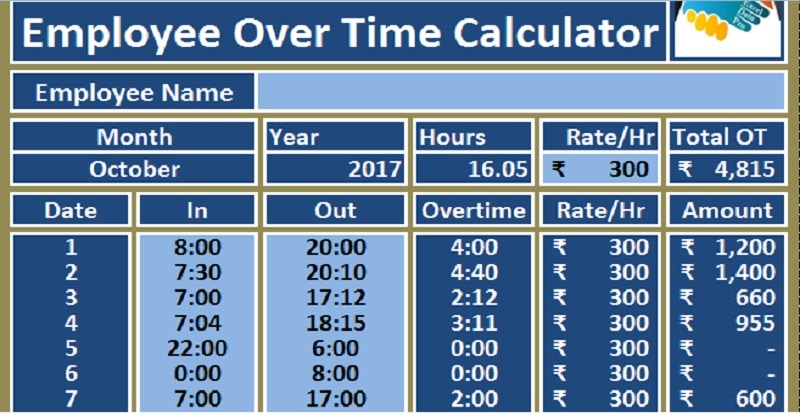

Step 3: Multiply by Overtime Hours

Next, multiply your time and a half rate by the number of extra hours you worked.

Example:

If you worked 6 overtime hours:

£21.63 × 6 = £129.78 (overtime pay)

So, if you worked 40 hours at £14.42/hour and did 6 overtime hours at £21.63/hour, your total weekly earnings would be:

- Regular pay: £14.42 × 40 = £576.80

- Overtime pay: £21.63 × 6 = £129.78

- Total pay = £706.58

Real-Life Examples

Let’s look at a few more scenarios to make this super clear.

Example 1: Hourly Worker Doing Overtime

- Regular pay: £12/hour

- Overtime: 5 hours

Step 1: £12 × 1.5 = £18/hour

Step 2: £18 × 5 = £90 overtime pay

Example 2: Working on a Holiday

Let’s say you’re scheduled on a public holiday, and your employer offers time and a half for those shifts.

- Regular pay: £10/hour

- Hours worked: 8

£10 × 1.5 = £15

£15 × 8 = £120 earned for the day

Compare that to your normal £10 × 8 = £80, and you’re making £40 more just for working the holiday.

Example 3: Salaried Employee on Call

Suppose your contract says you’ll get time and a half for any weekend work, even though you’re salaried.

- Annual salary: £40,000

- Weekly hours: 40

- Weekend work: 4 hours

Hourly rate: £40,000 ÷ 52 = £769.23/week

£769.23 ÷ 40 = £19.23/hour

£19.23 × 1.5 = £28.85/hour

£28.85 × 4 = £115.40 in extra pay

Time and a Half Pay Calculator (Quick Formula)

Use this quick formula to do the math:

Time and a Half Pay = Regular Hourly Rate × 1.5 × Overtime Hours

Or use this shortcut version:

Total Earnings = (Hourly Rate × Regular Hours) + (Hourly Rate × 1.5 × Overtime Hours)

If math isn’t your thing, you can also use free online calculators—just search “time and a half calculator” and plug in your numbers.

Why Is Time and a Half Important?

Besides just being extra cash, time and a half serves a bigger purpose:

- It rewards extra effort – You’re giving more time, so you should be compensated more.

- It protects employees – Labor laws are designed to stop employers from overworking staff for low pay.

- It boosts morale – Getting paid more for weekends or holidays makes those shifts easier to accept.

Common Questions About Time and a Half

❓ Is time and a half required by law?

Not always. It depends on your country and local labor laws.

- In the UK, there’s no legal requirement for overtime pay, but your average pay for the total hours worked must not fall below minimum wage.

- In the US, federal law (FLSA) requires time and a half after 40 hours per week for non-exempt employees.

Always check your contract and local labor laws to be sure.

❓ Can salaried employees get time and a half?

Yes, if:

- They’re considered non-exempt (under U.S. law)

- Their employment contract offers overtime or special shift pay

- They’re doing work outside of regular duties or hours

❓ What’s the difference between time and a half and double time?

- Time and a half = 1.5× your regular rate

- Double time = 2× your regular rate

Some employers offer double time for working on major holidays or extra-long shifts. Always confirm the rate beforehand.

❓ How do I know if I qualify for time and a half?

You should:

- Review your contract or offer letter

- Ask HR about company overtime policies

- Check if you’re considered exempt or non-exempt under labor law

- Track your hours (apps like Toggl or Clockify can help)

❓ Do I get taxed on time and a half pay?

Yes. All overtime pay is subject to income tax, national insurance (UK), or FICA (US). But you’ll still take home more than your base hourly rate.

Final Thoughts: Time and a Half Is Money in Your Pocket

Understanding how time and a half works isn’t just useful—it’s essential if you want to make sure you’re being paid fairly.

Whether you’re working late, covering a holiday, or putting in weekend hours, time and a half is your reward for going the extra mile. And now that you know how to calculate it step by step, you can confidently check your payslip and know exactly what to expect.

Quick Recap:

- Time and a half = regular rate × 1.5

- Applies to overtime, holidays, or special shifts

- Use the formula: Hourly Rate × 1.5 × Extra Hours

- Always check your contract and local laws

So the next time you’re asked to stay a bit late or cover that Sunday shift, you’ll know exactly how much that extra time is really worth.

Sure! Here’s a short and concise FAQ section about calculating time and a half, perfect for quick reference:

🧾 Quick FAQs – Time and a Half

❓ What is time and a half?

Time and a half means you earn 1.5 times your regular hourly rate for certain hours—like overtime or holiday shifts.

❓ How do I calculate time and a half pay?

Use this formula:

Hourly rate × 1.5 × overtime hours

❓ When do I get time and a half?

Usually for:

- Overtime hours (over 40/week or 8/day)

- Holiday or weekend shifts

- On-call or emergency hours

(Depends on your contract and local labor laws)

❓ Does time and a half apply to salaried workers?

Sometimes. If you’re non-exempt, or your contract allows for it, yes. Exempt salaried workers usually don’t qualify.

❓ Is overtime pay taxed?

Yes, it’s taxed just like your regular income.